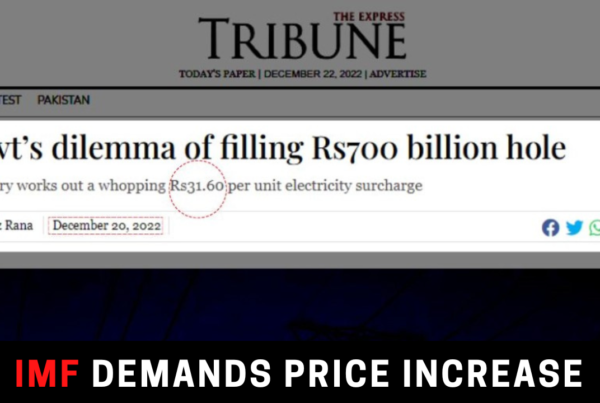

The photovoltaic (PV) module industry is experiencing a dynamic shift in pricing and market conditions, with significant implications for manufacturers and consumers alike. In recent years, the price of solar panels in China has seen a significant drop, from 0.235 dollars per watt (equivalent to 68 rupees per watt) in February to now being below 0.14 dollars per watt (40 rupees per watt). Surprisingly, in February, the price of Pakistani solar panels, labeled as LCs, had surpassed even 130 rupees per watt. Back in 2014, when the exchange rate was 65 rupees to 1 dollar, solar panels were available at 78 rupees per watt. Similarly, in 2018, with an exchange rate of 134 rupees to 1 dollar, panels were priced at 36 rupees per watt.

Today, with solar panels at their lowest at 44 rupees per watt, and considering the dollar is still relatively expensive, one might wonder about the dynamics at play. It’s worth noting that the mentioned cost does not include freight, which ranges from 700-1500 dollars per container, translating to roughly 1-2 dollars per panel. This suggests a certain level of profiteering by the solar industry. Adding the inland transport fee to a city like Islamabad, it becomes evident that the solar mafia has indeed engaged in price gouging. When these additional costs are factored in, it challenges the assumption that distributors are making excessive profits. It’s crucial to acknowledge that inland transport costs are relatively low, and there are other charges such as Bank/LC fees, insurance, and customs. Nevertheless, when viewed on a per-watt basis, all these expenses are relatively minimal.

Dynamics of PV Module Pricing and Market Trends

The primary factor contributing to the high costs was the import ban, as imports could only be conducted through Letters of Credits (LCs), and banks were hesitant to open LCs due to foreign exchange concerns. Beyond the usual expenses cited by many, importers had to allocate approximately 1.5-2 million rupees per container, costs that often go unaccounted for. Consequently, as prices began to plummet, many importers faced losses, especially when their containers were stuck at the port for months. It’s important to recognize that earnings in this industry are closely tied to the associated risks and the scale of investment.

A recent analysis of the Bill of Materials (BOM) for a 595W module reveals intriguing insights. The procurement of raw materials for a 200MW project has yielded what is believed to be the most competitive prices from China, indicating that the cost of raw materials has hit rock bottom, standing at a remarkable 0.136$/w. Factoring in non-material costs, the final manufacturing cost is calculated at 0.173$/w. Taking into account a modest 6.36% profit margin, the projected Free On Board (FOB) price is estimated to be 0.189$.

The pricing landscape of PV modules is multifaceted, driven by a complex interplay between manufacturers of various components and production equipment. Notably, the data highlights that prices may vary depending on the production capacity of manufacturers, particularly those with multiple GW production lines.

However, the surge in the number of brands and production units in China has led to an oversupply of modules, primarily destined for export markets. The Russia-Ukraine conflict has dealt a significant blow to exports, resulting in substantial reductions in imports by key regions such as Europe. Consequently, storage facilities are now brimming with excess inventory.

Looking ahead, market experts anticipate that current low prices will hold steady for the next six weeks. However, a shift is anticipated after mid-December, with prices projected to rise. Following Chinese holidays, prices are forecasted to stabilize at approximately 0.18$ per watt by the close of February 2024. One contributing factor to this market transition is the technological shift towards N-Type modules, indicating a broader industry trend towards higher efficiency and performance.

In light of these developments, some industry stakeholders have reported acquiring modules from China at prices ranging from FOB 0.12 to 0.13$/w. This sudden market shift has left many puzzled, prompting them to seek deeper insights into the underlying reasons driving these fluctuations.

Now, with prices having stabilized, even if the dollar were to come down to 136 rupees, the overall cost in terms of percentage may not see a significant reduction, potentially impeding the expected savings. This complex interplay of factors highlights the intricate nature of the solar industry in both China and Pakistan.

In conclusion, the PV module industry is navigating a complex landscape of pricing dynamics and market conditions. The interplay between raw material costs, production capacities, and global events such as geopolitical conflicts are shaping the trajectory of the industry. As manufacturers and consumers adapt to these changes, it will be crucial to monitor how these trends evolve and influence the broader renewable energy landscape.

For a consumer, if you are willing to pay extra for N-type (despite within one brand consideration its fill factor is less than P-type), HJT, or bi-facial panels to get the extra yield, you can heavily off set the yield with P-type of the same brand with the same kind of premium. Also, if you wait it will hinder your savings from today. At that time, tariffs may be reverted and the all-time highest profit composition due to cheapest rates, and together the fastest return on investment might not be achieved by the upcoming political party after the general elections.

Join our updates WhatsApp Channel: https://whatsapp.com/channel/0029VaDHmGhGE56tPOwJxO3c